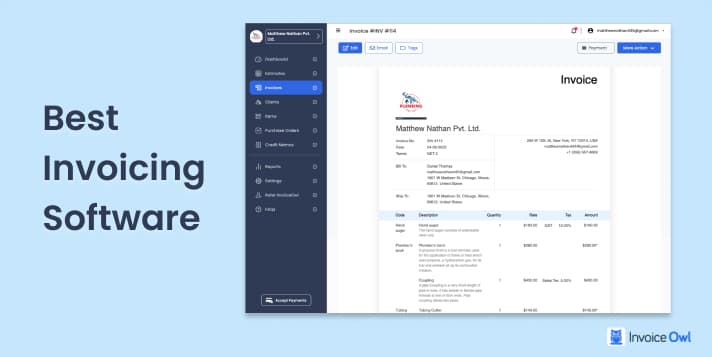

Best Invoicing Software for Contractors in 2025

Best Invoicing Software for Contractors: As contractors, they often have to handle multiple tasks at once, including sourcing clients, managing projects, and overseeing daily activities.

However, there is one aspect of your business which often slips to the bottom of the priority list: invoicing. It’s an essential, but time-consuming task many contractors dislike. How would it be if invoicing didn’t need to be so hard?

It would be great if you were able to simplify invoicing, save time, reduce errors, and improve cash flow at the same time.

Good invoicing software can make a significant difference to a business’s finances. This makes it easier to keep track of payments and stay on top of your finances. In this guide, we will examine the best invoicing software for contractors in 2025.

It does not matter whether you are a solo freelancer, a small contractor, or part of a larger team, there is a software that you can use to streamline your invoicing process and increase your efficiency.

We will review the essential features to look for. We will guide you through the top software options, highlighting how the right tool can maximize your productivity, minimize errors, and improve your cash flow.

Keep reading to discover the best options available if you wish to take your invoicing and ultimately your business to the next level.

Best Invoicing Software

Why do contractors need invoicing software?

Invoicing is essential for contractors. However, manually, it can be both time-consuming and error-prone.

Managing invoices, tracking payments, and calculating taxes can take up valuable time that could be spent on actual work.

Invoicing software addresses these challenges and offers several benefits that significantly improve your workflow.

Without invoicing software, contractors may spend hours generating invoices, calculating totals, and chasing overdue payments.

These tasks are repetitive and prone to human error. Invoicing software automates these processes, making them quicker and more accurate.

You can quickly generate invoices, track paid and unpaid invoices, and send automated payment reminders all with just a few clicks.

Additionally, invoicing software helps you stay tax-compliant. Most platforms come with built-in tax calculation features, which ensure you’re charging the right tax rates.

Invoices can automatically adjust based on your location or the client’s, simplifying the invoicing process.

This allows you to focus on what you do best delivering quality work to your clients while leaving the administrative tasks to the software.

Furthermore, invoicing software boosts professionalism. By sending branded invoices, you enhance your company’s image and build trust with clients.

When clients see clear, well-designed invoices that reflect your business, they’re more likely to pay promptly, leading to better cash flow and fewer disputes.

In summary, invoicing software streamlines your processes, reduces errors, improves cash flow, and enhances your professional image. These are key factors in growing a successful contracting business.

Top Features to Look for in Invoicing Software

Choosing the right invoicing software is about more than generating invoices. When evaluating your options, there are several key features to look for. These features will streamline your workflow, save time, and ensure accuracy.

1. Customizable invoice templates

Customizing invoices with your logo, company information, and payment terms helps you maintain a professional image.

Look for invoicing software that allows you to design invoices that reflect your brand. You can often include terms and conditions, payment options, and specific job details.

2. Time tracking.

Contractors often charge by the hour or per project. Integrated time tracking is essential.

It allows you to log hours worked and automatically generate invoices based on those hours. This feature eliminates manual tracking, ensuring billing accuracy.

Time tracking tools can also track multiple projects and clients at once, avoiding confusion and ensuring each job is billed appropriately.

By streamlining this process, you save time and reduce billing disputes.

3. Automated payment reminders

Automated payment reminders are a game-changer for contractors.

Instead of chasing down late payments or constantly reminding clients about due dates, invoicing software can automatically send reminders when payments are due or overdue.

Automated notifications can significantly reduce collections time and improve cash flow.

Automated reminders also help you maintain a professional relationship with your clients.

They don’t have to feel pressured by your follow-ups, as the system handles reminders for you.

4. Expense tracking

Tracking business expenses directly within your invoicing software is another key feature to consider.

When invoicing clients for a project, you want to ensure you account for all associated costs. This includes materials, labor, and other expenses.

Expense tracking allows you to easily log and categorize these expenses.

These expenses can be integrated directly into your invoices, ensuring that your billing reflects the true cost of the project.

This also makes tax season simpler, as you have a record of all your expenses in one place.

5. Payment integration

Payment integration allows clients to pay directly from their invoice using various payment methods, including credit cards, bank transfers, and PayPal.

Look for invoicing software that offers multiple payment options to give your clients flexibility and convenience.

This feature speeds up the payment process and ensures clients can pay securely and quickly. This can drastically reduce your payment cycle time and ensure you get paid faster.

6. Mobile compatibility

Contractors are frequently on the move. Whether you’re on a job site or meeting with clients, creating and sending invoices from your mobile device is essential.

Look for invoicing software with a mobile app or responsive website that allows you to generate, track, and send invoices from anywhere.

Mobile compatibility ensures invoicing doesn’t take a backseat to your work. Mobile invoicing keeps you on top of payments and client interactions in real-time.

Best Invoicing Software for Contractors: Our Picks

1. QuickBooks Self-Employed

QuickBooks Self-Employed is robust invoicing and accounting software designed specifically for freelancers and contractors.

It allows you to track income, expenses, and taxes, while also providing simple tools to create professional invoices and manage your finances.

Pros and cons:

- Pros:

- Tracks mileage and expenses automatically.

- Tax estimation tools for quarterly tax filings.

- User-friendly interface with simple navigation.

- Integration with TurboTax for streamlined tax filing.

- Cons:

- Lacks some advanced features compared to QuickBooks desktop.

- Only available for U.S. tax filings.

- Limited reporting options.

Key Features:

- Customizable invoices with automatic tax calculations.

- Automatic tracking of mileage and business expenses.

- Integration with TurboTax for easy tax filing.

Best For: Freelancers and independent contractors who need a straightforward invoicing solution that also helps with taxes and expense tracking.

2. FreshBooks

Overview: FreshBooks is one of the most popular invoicing and accounting tools among small business owners and contractors. It combines ease of use with powerful features like time tracking, client management, and project management. FreshBooks streamlines both invoicing and accounting tasks, making it easier to manage your business.

Pros and cons:

- Pros:

- Excellent customer support with 24/7 availability.

- Time tracking tools for hourly contractors.

- Recurring invoices for long-term clients.

- Multiple payment integrations for easier client payments.

- Cons:

- Pricing can be steep for solo contractors with low client volumes.

- Some advanced features are only available in higher-tier plans.

Key Features:

- Customizable invoices and estimates.

- Time tracking for hourly clients.

- Project management tools to keep track of client tasks.

Best For: Contractors who need a complete invoicing solution with time tracking and project management tools.

3. Zoho Invoice

Overview: Zoho Invoice is a free and feature-packed invoicing tool perfect for small businesses and freelancers. It allows you to create professional invoices, automate reminders, and track time spent on projects. Zoho’s powerful integrations with its other tools also make it a flexible option for businesses looking to scale.

Pros and cons:

- Pros:

- Free plans are available with many features.

- Multi-currency and multi-language support.

- Automated payment reminders and recurring billing.

- Integration with other Zoho tools for added functionality.

- Cons:

- Limited integration with third-party apps.

- Customer support can be slow at times.

Key Features:

- Customizable invoice templates.

- Multi-currency and multi-language support.

- Recurring billing and automated reminders.

Best For: Small contractors or freelancers looking for an affordable, no-cost solution for invoicing and basic accounting.

4. Wave

Wave is free, all-in-one invoicing and accounting software perfect for small contractors or freelancers. It provides unlimited invoicing, accounting, and payment tracking features without any upfront costs, making it an ideal choice for businesses just starting out.

Pros and cons:

- Pros:

- Completely free with invoicing and accounting features.

- Unlimited invoicing and payment tracking.

- Strong integration with PayPal and credit card processors.

- Simple and easy-to-use dashboard.

- Cons:

- Lacks advanced features like project management and task tracking.

- Limited customer support compared to paid tools.

Key Features:

- Unlimited invoicing and expense tracking.

- Integration with PayPal and credit cards for easy payment processing.

- Simple, intuitive dashboard for managing finances.

Best For: Small contractors and freelancers who need basic invoicing and accounting software at no cost.

5. Invoice Ninja

Invoice Ninja is a versatile invoicing platform that offers both free and paid plans. It’s ideal for contractors who need advanced invoicing features and project management tools. Invoice Ninja allows you to create professional invoices, track expenses, and manage clients easily.

Pros and cons:

- Pros:

- Free plan with a wide range of features.

- Integration with over 40 payment gateways.

- Time tracking and task management features.

- Recurring invoices and automated reminders.

- Cons:

- The interface may feel complex for new users.

- Premium features require a paid plan.

Key Features:

- Recurring billing and automated reminders.

- Time tracking and task management.

- Integration with over 40 payment gateways.

Best For: Contractors with multiple clients or projects who need invoicing automation and project management features.

And.Co

And.Co is an all-in-one tool that combines invoicing, time tracking, and expense management. It’s an ideal choice for freelancers and contractors who need a simple, easy-to-use platform that covers all their business needs.

Pros and cons:

- Pros:

- User-friendly interface that’s easy to navigate.

- Integrated time tracking and task management tools.

- Automated invoicing and payment reminders.

- Integration with Fiverr for freelancers.

- Cons:

- Higher prices compared to some other options.

- Lacks advanced reporting features.

Key Features:

- Customizable invoices with your branding.

- Time tracking and task management for efficient project management.

- Expense tracking and reporting.

Best For: Freelancers and small contractors who need a simple tool that combines invoicing with task management and time tracking.

Pricing Plans: Finding Affordable Solutions

Here’s a breakdown of the pricing for popular invoicing tools:

| Software | Free Plan | Basic Paid Plan | Premium Plan |

|---|---|---|---|

| QuickBooks | No | $15/month | N/A |

| FreshBooks | No | $15/month | $50/month |

| Zoho Invoice | Yes | $9/month | N/A |

| Wave | Yes | Free | N/A |

| Invoice Ninja | Yes | $10/month | $14/month |

| And.Co | Yes | $18/month | $36/month |

How to Choose the Right Invoicing Software for Your Business

Choosing the right invoicing software depends on several factors, such as the size of your business, the complexity of your projects, and your budget. Here’s how to evaluate the options:

- Business Size: For solo freelancers, simple tools like Zoho Invoice or Wave might suffice. However, larger businesses with multiple contractors may need a more advanced solution like FreshBooks or Invoice Ninja.

- Features Needed: If you need advanced features like time tracking, recurring billing, or project management, look for software that offers these functionalities. For simple invoicing, a tool like Wave might be sufficient.

- Budget: Many invoicing tools offer free plans, such as Wave and Zoho Invoice, while others, like QuickBooks and FreshBooks, offer premium plans. Consider your budget and the scale of your business when selecting software.

- Ease of Use: You don’t want to spend too much time learning how to use your invoicing software. Choose an intuitive tool with a simple interface, and take advantage of free trials to test them out.

- Customer Support: Reliable customer support is important for resolving issues. Look for software with comprehensive support options, including live chat, email support, and tutorials.

Benefits of Using Invoicing Software for Contractors

- Efficiency: Automating invoicing, reminders, and expense tracking saves time and reduces errors.

- Accuracy: Ensure accurate calculations and tax reporting, reducing costly mistakes.

- Professionalism: Branded invoices reflect your business’s professional image, building trust with clients.

- Cash Flow: Faster invoicing and automated payment tracking help you get paid on time, improving cash flow.

Common Mistakes to Avoid When Using Invoicing Software

- Not Customizing Invoices: Personalize your invoices to match your branding and maintain consistency.

- Ignoring Tax Settings: Ensure your tax rates are configured properly to avoid mistakes.

- Neglecting Expense Tracking: Log all your business expenses to ensure accurate invoices and you’re prepared for tax season.

- Skipping Payment Reminders: Set up automated reminders to keep payments on track and avoid delays.

Conclusion

Invoicing software isn’t just about convenience – it’s about making your business run smoother, faster, and more efficiently.

With the right invoicing software, you can improve cash flow, cut down on human error, and ensure that you get paid on time.

Now that you’ve seen all the options, you won’t have to worry about choosing invoicing software. You can set your business up for long-term success with the right software, whether it’s something simple and free or something robust with project management functionality.

By now, you should know what makes a good invoicing tool and which ones cater to your specific needs. It’s not just about generating invoices.

These tools can help you stay organized, track your expenses, and ultimately get paid faster, so you can focus on what really matters. You don’t have to worry about invoicing anymore.

Choose the software that’s right for you, and watch your business thrive as your billing processes get streamlined and you focus on what you do best. Why not get started with the right invoicing software right now?

Frequently Asked Questions

What is invoicing software?

Invoicing software is a tool that automates the process of creating, sending, and managing invoices. It helps businesses streamline billing, track payments, and reduce errors. Invoicing software often includes features like customizable templates, tax calculations, and payment integrations, making it easier for contractors to manage their finances and get paid promptly.

Why should contractors use invoicing software?

Contractors should use invoicing software to save time, reduce errors, and maintain professionalism. The software automates invoicing, tracks overdue payments, and integrates with payment gateways, helping contractors get paid faster. It also helps manage expenses and generates reports, making it easier to track profits and prepare for tax season.

Can invoicing software help with tax calculations?

Yes, many invoicing tools include automatic tax calculation features that adjust based on your location and the client’s. This ensures you apply the correct tax rates to your invoices. Some tools also generate tax reports, which can be helpful during tax season, saving you time and effort in manual calculations.

Is invoicing software secure for online payments?

Most invoicing software is designed with security in mind. They integrate with secure payment gateways like PayPal and Stripe, ensuring that your clients’ payment information is protected. Additionally, many tools comply with industry standards for data security, offering encrypted payment processing to minimize the risk of fraud.

Can invoicing software be used for international clients?

Yes, many invoicing tools, such as Zoho Invoice and FreshBooks, support multi-currency and multi-language invoicing. This makes it easy for contractors to bill international clients. These tools automatically adjust invoices for currency exchange rates, ensuring accurate billing and preventing errors when working with clients across different countries.

How do I choose the right invoicing software for my business?

When choosing invoicing software, consider your business size, needs, and budget. Look for features like time tracking, project management, and payment integration. Test free trials to see how user-friendly the software is, and check for customer support options. Compare pricing plans to find one that fits your budget and provides the features you need.

Can invoicing software integrate with accounting software?

Yes, many invoicing tools integrate with accounting software, allowing you to streamline your finances. For example, QuickBooks Self-Employed integrates with QuickBooks accounting software, making it easier to manage your invoices and track expenses. These integrations save time by syncing data across both platforms, ensuring your financial records are up-to-date and accurate.

How much does invoicing software typically cost?

The cost of invoicing software varies depending on the features and the plan you choose. Many tools, like Wave and Zoho Invoice, offer free plans for basic invoicing. Paid plans can range from $10 to $50 per month, with higher-tier plans offering advanced features like project management, time tracking, and client reporting.

Can invoicing software help contractors manage multiple clients?

Yes, invoicing software is designed to handle multiple clients, making it easier for contractors to manage different projects at once. You can create and send personalized invoices for each client, track payment statuses, and set up recurring billing for long-term clients. This helps contractors stay organized and ensure they’re paid on time.

How can invoicing software improve cash flow for contractors?

Invoicing software helps contractors improve cash flow by automating invoicing, tracking overdue payments, and sending automated reminders. It can also integrate with payment systems like PayPal, allowing clients to pay instantly. Faster invoicing and payment processing mean contractors receive their payments sooner, reducing delays and improving cash flow over time.